Back in the day, HDFC Bank offered up to 10x points for loading HDFC Forex cards via HDFC credit cards. Now, they have launched it again. When loading or reloading your HDFC Forex card with your HDFC Bank Credit cards, you will earn 5x points. Effectively, you earn 5x points on Forex spending when you use an HDFC Forex Card.

Earn 5x Points on Forex Spends with HDFC Credit Cards

- Promotion: 5x Points on Loading/Reloading HDFC Forex Cards with HDFC Credit Cards.

- Offer Period: 1st January 2025 to 31st March 2025.

- Maximum Points: 15000 Points Per Month.

- Minimum Transaction Value (Loading/Reloading): ₹ 15000.

- Eligible Loading Transaction should be done on any of these three links:

- Loading or Reloading through other links is not eligible.

Eligible Credit Cards

Not all credit cards are eligible however, all major HDFC Credit Cards are eligible for this promotion:

- Regalia First

- Regalia

- Regalia Activ

- Regalia Gold

- Diners Privilege

- Diners Black

- Diners Black Metal

- Infinia

- Infinia Metal

How many points can you earn?

With the 5x promotion, you can earn 15000 points each month. The amount that will earn you these 15000 points is ₹ 112500. Even though I don’t have this card, I do have travel coming up, and there are expenses in forex, so with a gross 16.67% return, it makes a lot of sense for me to get an HDFC Forex Card.

| Card | Base Earning (Per ₹ 150) | Promotion 4x Points | Total Points (Per ₹ 150) | Points Earned on ₹ 15000 | Gross Earn Rate |

| Regalia First | 3 | 12 | 15 | 1500 | 3% |

| Regalia | 4 | 16 | 20 | 2000 | 6.67% |

| Regalia Activ | 4 | 16 | 20 | 2000 | 6.67% |

| Regalia Gold | 4 | 16 | 20 | 2000 | 6.67% |

| Diners Privilege | 4 | 16 | 20 | 2000 | 6.67% |

| Diners Black | 5 | 20 | 25 | 2500 | 16.67% |

| Diners Black Metal | 5 | 20 | 25 | 2500 | 16.67% |

| Infinia | 5 | 20 | 25 | 2500 | 16.67% |

| Infinia Metal | 5 | 20 | 25 | 2500 | 16.67% |

HDFC Forex Cards

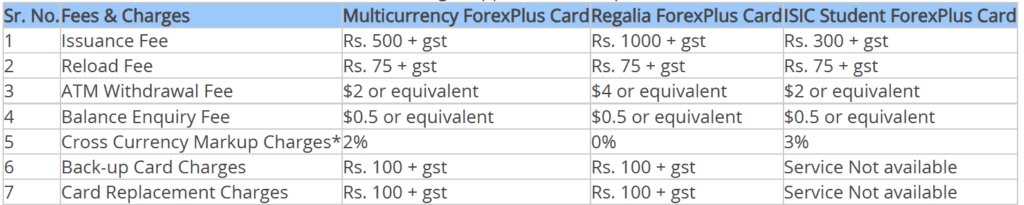

There are three HDFC Forex cards available. If you are not a student, you can get a Multi-Currency ForexPlus or Regalia ForexPlus card.

- You can load multiple currencies, 22 to be exact, on the Multicurrency Forex Plus card. The cash withdrawal charges are also nominal. However, you may also pay ATM withdrawal charges to the bank from which you withdrew cash. There are loading charges, too, which are reasonable.

- I find the Regalia ForexPlus Card more suitable for me. This is a single-currency card, and there is no cross-currency forex markup. I don’t have to load a specific currency every time. However, I must pay a small currency conversion tax on this.

Things to Know

- Forex Cards are complex. Why complex? Because there are multiple charges. Firstly, you must pay Issuance Fees, which can be waived on loading transactions with a minimum of USD 1000. Then, you have to pay loading fees of INR 75 for each load.

- Apart from that, you also pay a forex markup when loading a forex card. For example, Today’s USD to INR rate is INR 86.56. But HDFC has special rates that are updated daily. As per the latest available rate, you will have to pay INR 88.43 for each USD. That is approximately 2% plus GST. So, effectively, you are paying a forex markup upfront.

- In addition, if you have a Multi-Currency Card and move one currency to another, you will still pay conversion charges of around 2% plus GST.

- Currency Conversion Tax:

- Apart from above charges, you also have to pay GST on currency conversion which is 0.18% for up to INR 1 Lakh with minimum of INR 45 charges, above INR 1 Lakh and up to INR 10 Lakh 0.09% and above Ten lakhs 0.018%.

- Summary of Charges:

- Remember, 5x points are only given if the transaction is done on any three links. You can also set up a forex currency tracker while you are travelling to know the rates available.

How much charges will I pay and Save?

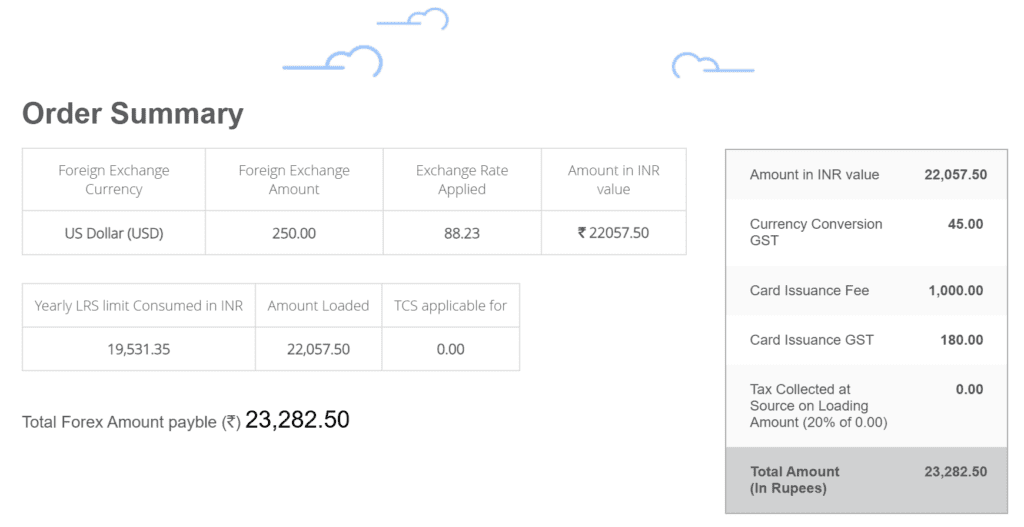

I won’t load USD 1000 to get my Joining fees waived. One reason is that I’m an HDFC Imperia customer, and one of the benefits of having Imperia is that I can get 50% of joining fees waived. I plan to load INR 15K to INR 50K, depending upon my requirements. I will most likely get Regalia ForexPlus.

Let’s say I load INR 15K this how much I pay and save:

- Card Issuance Fees: INR 590 (For Imperia)

- Loading Charges: INR 89

- Forex Mark Up: INR 317

- Global Value Program Benefit Lost: INR 150

- Currency Conversion Tax: 45

- Total Cost: INR 1191

- Regular Points Earned on Infinia: INR 500

- Accelerated Points Earned: 2000 (Additional Benefit)

- Net Benefit Due to Promotion: INR 809 or 5.39% (Benefit will increase on the subsequent transaction since card issuance fees are one-time)

So, I effectively give away 8% of the total value earned. However, this net benefit get increased to 8.68% if i load INR 50K in single transaction. The total benefit would be 12% after all charges.

Other Useful Reading

If you are new to HDFC Forex Cards, these are some of the links which I find useful:

- HDFC Bank Regalia ForexPlus Card Review

- HDFC Multicurrency Platinum ForexPlus Chip Card Review

Bottomline

The promotion to earn 5x points on Forex spends using HDFC Credit Cards is good for Dinners Black & Infinia card holders on loading HDFC Forex cards. If you have other cards, I don’t think it makes sense unless you already have an HDFC Forex card. At the same time, there are several products available in today’s market with which you can pay zero forex charges without any hassle.