SBI quietly launched its Miles Credit Cards. There was nothing great about these cards, barring a few things. Three cards have been launched under the “Miles Segment” by SBI. Miles has been a hot topic since Axis took over realms from Citi Bank. Here is how these new SBI Miles Credit Cards fairs.

SBI Miles Credit Cards

SBI has launched three SBI Miles Credit Cards under the miles segment, which are:

- SBI Card Miles

- SBI Card Miles PRIME

- SBI Card Miles ELITE

They didn’t give its cards a fancy name and just added PRIME or ELITE behind them to differentiate.

Comparison at a Glance

Here is the summarized things comparison of these cards:

| Particulars | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| Annual Fees | INR 1499 | INR 2999 | INR 4999 |

| Welcome Benefits | 1500 Travel Credits | 3000 Travel Credits | 5000 Travel Credits |

| Spending [Welcome Benefits] | INR 30K in 60 Days | INR 60K in 60 Days | INR 1 Lakh in 60 Days |

| Fee Waiver | INR 6 Lakh | INR 10 Lakh | INR 15 Lakh |

| Lounge Access [Domestic] | 2/QTR and 4/YR | 2/QTR and 8/YR | 2/QTR and 8/YR |

| Lounge Access [International] | NA | 2/QTR and 4/YR | 2/QTR and 6/YR |

| Forex Markup | 3% | 2.5% | 1.99% |

| Basic Miles Earning | 1 Per INR 200 | 2 Per INR 200 | 2 Per INR 200 |

| Travel Miles Earning | 2 Per INR 200 | 4 Per INR 200 | 6 Per INR 200 |

| Milestone Spending | INR 5 Lakh | INR 8 Lakh | INR 12 Lakh |

| Milestone Benefits | 5000 Travel Credits | 10000 Travel Credits | 20000 Travel Credits |

What are Travel Credits?

The Travel Credits issued on SBI Miles cards are like regular points or miles earned on your other cards. They are valid for 24 months from the date of Accrual.

The value of these credits varies based on how you redeem them. Here is how they are valued:

| Redeemed For | Value |

| Air Miles/Hotel Points | 1:1 |

| Travel Bookings | 1:0.5 |

| Vouchers etc | 1:0.25 |

Reward Rates

The base reward rates of SBI Miles credit cards are bad. A 1% reward rate on an INR 6K fee card is not great. Even the accelerated travel rewards are way behind the Axis Atlas.

| Particulars | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| Base Reward Rate | 0.5% | 1% | 1% |

| Travel Reward Rate | 1% | 2% | 3% |

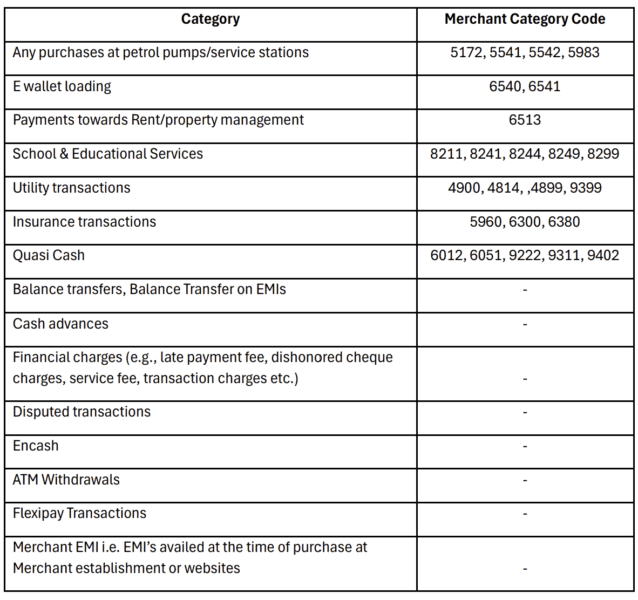

Spending Exclusions

Not just the lower base reward rates, you also don’t earn any miles or Travel Credits on below spending:

- Fuel Spending

- Wallet Loading

- Rent/Maintenance

- Education

- Utilities

- Government Services

- Insurance

- Quasi Cash

The usual exclusions now applicable to most cards have been applied to SBI Miles Cards.

Accelerated Earning Inclusions

One difference between SBI Miles credit cards is that you can accelerate Miles on several travel-related spending, including Travel Agent bookings and cabs. However, this still doesn’t beat Axis Atlas Cards, which gives a 4% reward. Anyway, this may still be useful for people:

| MCC | Business Type |

|---|---|

| 3005 | British Airways |

| 3007 | Air France |

| 3008 | Lufthansa German Airlines |

| 3010 | Royal Dutch Airlines (KLM Airlines) |

| 3020 | Air India |

| 3026 | Emirates Airlines |

| 3034 | Etihad Air |

| 3047 | Turkish Airlines |

| 3075 | Singapore Airlines |

| 3136 | Qatar Airways |

| 3501 | Holiday Inns |

| 3509 | Marriott |

| 3640 | Hyatt Hotels/International |

| 3649 | Radisson |

| 4111 | Transportation |

| 4121 | Taxicabs and Limousines |

| 4131 | Bus Lines |

| 4214 | Motor Freight Carriers, Trucking–Local/Long Distance Moving and Storage Companies Local Delivery |

| 4511 | Air Carriers Airlines–not elsewhere classified |

| 4722 | Travel Agencies and Tour Operators |

| 4784 | Bridge and Road Fees, Tolls |

| 4789 | Transportation Services Not Elsewhere Classified |

| 7011 | Lodging Hotels, Motels, Resorts–not elsewhere classified |

| 7512 | Automobile Rental Agency–Not Elsewhere Classified |

How many miles or Travel Credits can you earn?

Here is how many miles you can travel if you have zero travel-related spending on all eligible spending

100% Base Spending

| Spending | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| 2.5 Lakh | 1250 | 2500 | 2500 |

| 5 Lakh | 7500 | 5000 | 5000 |

| 7.5 Lakh | 8750 | 7500 | 7500 |

| 8 Lakh | 9000 | 18000 | 8000 |

| 12 Lakh | 11000 | 22000 | 32000 |

| 15 Lakh | 12500 | 25000 | 35000 |

100% Travel Spending

| Spending | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| 2.5 Lakh | 2500 | 5000 | 5000 |

| 5 Lakh | 10000 | 10000 | 10000 |

| 7.5 Lakh | 12500 | 15000 | 15000 |

| 8 Lakh | 13000 | 26000 | 24000 |

| 12 Lakh | 17000 | 34000 | 56000 |

| 15 Lakh | 20000 | 40000 | 65000 |

Achievable Reward Rate

The reward rate is pathetic for the price charged, even for the highest variant of the card. An INR 5K fee card gives a base reward rate of 1% that too if transferred to airline partners. Value would be halved if redeemed for travel bookings and one-fourth if used for vouchers, etc.

| Particulars | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| Minimum | 0.5% | 1% | 1% |

| Maximum | 2% | 3.25% | 4.67% |

Lounge Access on SBI Miles Credit Cards

Even though SBI Miles Credit Cards are travel cards, lounge access is limited. However, you can get additional lounge access for every INR 1 Lakh spent, which is also limited to domestic lounges. Who needs additional lounge access? Yes, it can be helpful for guest visits, but things don’t add up, especially for Elite cards.

| Particulars | SBI Card Miles | SBI Card Miles Prime | SBI Card Miles Elite |

| Lounge Access [Domestic] | 2/QTR and 4/YR | 2/QTR and 8/YR | 2/QTR and 8/YR |

| Lounge Access [International] | NA | 2/QTR and 4/YR | 2/QTR and 6/YR |

| Maximum Additional Lounge Access | 8/YR | 12/YR | 15/YR |

SBI Miles Credit Cards Transfer Partners

Most of the SBI transfer partners are the same as those available to HDFC or Axis Bank; however, a few new ones have also been added. (Updated list here)

Airline Transfer Partners

| Airlines | Frequent Flyer Program | Airline Alliance | Conversion Ratio |

| Air Arabia | AA Rewards | None | 2:1 |

| Air Canada | Aeroplan | Star Alliance | 1:1 |

| Air Asia | AirAsia rewards | None | 1:1 |

| Air India | Flying Returns | Star Alliance | 1:1 |

| Etihad Airways | Etihad Guest | None | 1:1 |

| AirFrance/KLM | Flying Blue | SkyTeam | 1:1 |

| Ethiopian Airlines | ShebaMiles | Star Alliance | 2:1 |

| Japan Airlines | JAL Mileage Bank | OneWorld | 2:1 |

| Saudia | AlFursan | SkyTeam | 2:1 |

| Spice Jet | SpiceClub | None | 1:1 |

| Thai Airways | Royal Orchid Plus | Star Alliance | 1:1 |

| Turkish Airlines | Miles&Smiles | Star Alliance | 2:1 |

| United Airlines | United Mileage Plus | Star Alliance | 2:1 |

| Qantas Airways | Qantas Frequent Flyer | OneWorld | 1:1 |

| Qatar Airways | Privilege Club | OneWorld | 2:1 |

| Vistara Airlines | Club Vistara | None | 1:1 |

Most of these Airline Partners have a transfer ratio of 1:1; considering the low miles earned, it would have been a bit better to keep everyone at 1:1. However, it is commendable that it added two new exclusive airline partners.

Hotels Transfer Partner

Most hotel partners are already available through other cards, but SBI added two new exclusive hotel partners.

| Hotels | Conversion Ratio |

| ALL-Accor Live Limitless | 2:1 |

| IHG One Rewards | 1:1 |

| Club ITC | 1:1 |

| Orchid Hotels | 1:1 |

| Shangri-La Circle | 6:1 |

| Wyndham Rewards | 1:1 |

Bottomline

SBI Miles credit cards offer nothing new except a few new transfer partners. However, there may still be value for some cardholders, which we will learn soon. Till then, these cards aren’t for everyone.