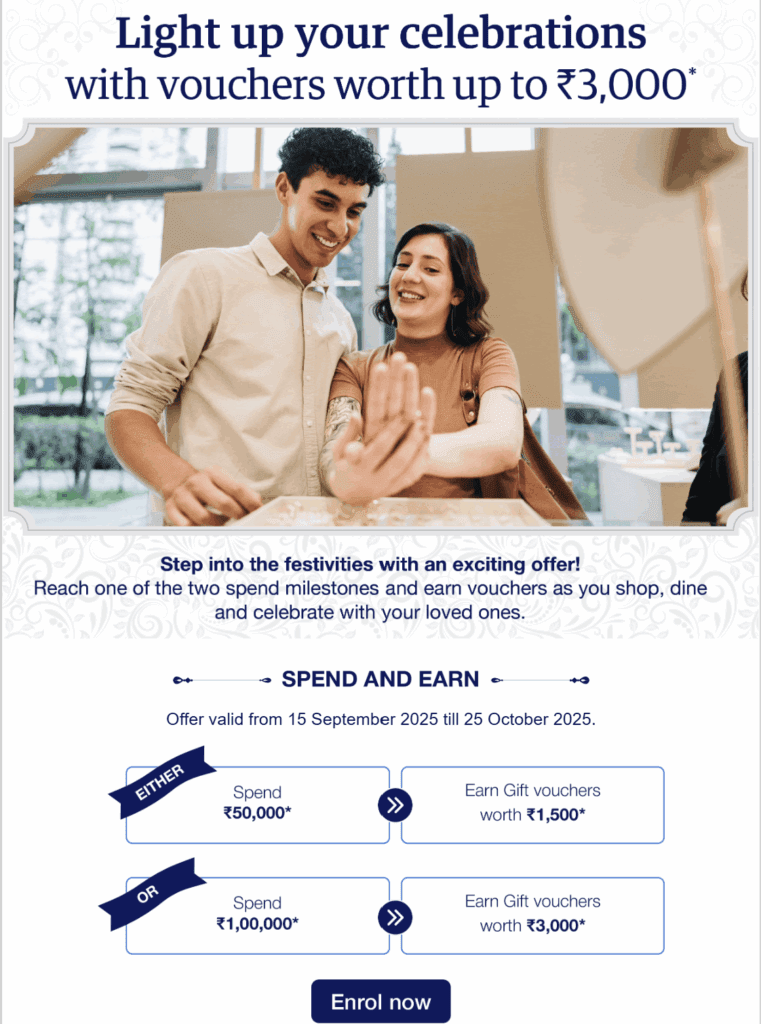

American Express is back with its usual Diwali spend-based offer. Spend-based offers are usually a feature from Amex and are made available twice a year (once for Jan-Apr and then usually between Sep-Nov). They also regularly have other good offers, such as earning bonus points, vouchers, and bonuses on transferring points. Similar to earlier offers, this offer gives free vouchers for spending a certain amount.

Amex Spend Based Offer: Basics (India)

Spend-based offers are targeted offers. Only those who receive an email from Amex are eligible for them, and this can vary between members.

Here, I received the offer of an INR 1.5K Voucher for spending INR 50K or ₹ 3K Voucher for spending ₹ 100K between 15 September 2025 till 25 October 2025 after enrolment.

- Enrollment is mandatory, and spending made after enrollment is only considered for this promotion.

- Once you have enrolled, you will receive the email confirmation.

Promotion Summary

The offer is simple. Spend a threshold amount, and you will receive a Voucher of your choice.

Here are the details:

| Offer | Get a Voucher for Spending Minimum Amount |

| Spending Amount | Varies by Person |

| What will you get | E-Vouchers |

| Offer Period | 15th Sep-25th Oct 2025 |

| Offer Start Date | From Date of Enrollment |

| Spend Considered | Spending from Enrollment till 25th Oct 2025 |

| Vouchers Receipt Date | December 15, 2025 |

| Reward Rate | 2.33%-3% |

- It is a good promotion; check your email from American Express, and if you have received it, enrol for the promotion. Or, make sure to enrol if you have a spending coming up.

Inclusions Exclusions

There is no exclusion on any spending for this promotion. However, annual fees, surcharges or transaction fees, financial charges, over-limit or delinquent charges are excluded. Also, Amex should be charged in full to be eligible as a spend.

Unlike earlier offers, this offer only applies to the card number mentioned in the email, as per the terms and conditions. However, supplementary or add-on cards are eligible need not be enrolled seperately.

Vouchers

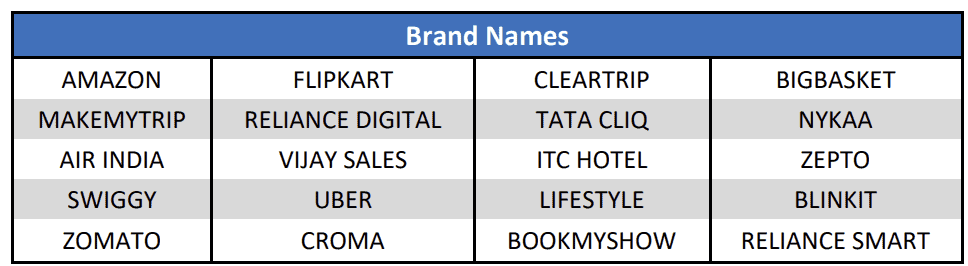

The vouchers from following brands will be issued:

A key thing to note here is that Vouchers will be valid for 25 days from the date of issuance. So, the time period for using vouchers will be short.

All Amex Spend Based Offer [Jan-Apr’25]

- 35K Voucher on Spending ₹ 15 Lakhs or ₹ 30K Voucher on Spending ₹ 10 Lakhs. [Link]

- 30K Voucher on Spending ₹ 10 lakhs or ₹20K Voucher on Spending ₹ 7 Lakhs [Link]

- 15K Voucher on Spending ₹ 5 lakhs or ₹20K Voucher on Spending ₹ 7 Lakhs [Link]

- 15K Voucher on Spending ₹ 5 lakhs or ₹12K Voucher on Spending ₹ 4 Lakhs [Link]

- 10K Voucher on Spending ₹ 3 lakhs or ₹12K Voucher on Spending ₹ 4 Lakhs [Link]

- 10K Voucher on Spending ₹ 3 Lakhs or 6K Voucher on Spending ₹ 2 lakhs [Link]

- 3K Voucher on Spending ₹ 1 lakh or ₹6K Voucher on Spending ₹ 2 Lakhs [Link]

- 3K Voucher on Spending ₹ 1 lakh or ₹1.5K Voucher on Spending ₹ 50K [Link]

- 1K Voucher on Spending ₹ 25K or ₹1.5K Voucher on Spending ₹ 50K [Link]

How to Maximize Amex Spend-Based Offer?

This offer is best for milestone cards like MRCC, Platinum Travel & Gold Charge cards. You not only get to earn amex points but also get vouchers over & above them. That effectively increases the overall reward ratio of these cards. You can also use Reward Multiplier to earn bonus points.

For Example, Amex Platinum Travel has two milestones, one at ₹ 1.9 Lac and the other at ₹ 4 Lac. Say you received a 6K Voucher on a 2 Lakhs spend offer; you will get 15K Bonus Points and another 6K Voucher, increasing the overall reward ratio.

Amex Spend Based Promotion History

| Period | Min Spend (INR) | Max Spend (INR) | Min Voucher (INR) | Max Voucher (INR) |

| Sep-Oct’25 | 25K | ≥15L | 1K | 35K |

| Jan-Apr’25 | 25K | 10 Lakh | 1K | 30K |

| Sep-Nov’24 | 25K | 10 Lakh | 1K | 30K |

| Jan-Apr’24 | 25K | 7 Lakh | 1K | 25K |

| Sep-Nov’23 | 25K | 5 Lakh | 1K | 25K |

| Sep-Nov’22 | 10K | 7 Lakh | 750 | 30K |

| Oct-Nov’21 | 10K | 8.5 Lakh | 750 | 70K |

Don’t Have An Amex? [Applications are Paused]

Bottomline

Amex’s spend-based targeted offer gives more on top of the rewards you earn. Plus, there is no exclusion on the type of spending, and all usual spending is eligible. Milestone Cardholders can benefit even more.