Axis recently notified changes to their HNI Credit Cards, Magnus & Reserve, which will be applicable from 1st September 2023. These changes are significant and give a complete makeover to its cards. Axis had enough of the cardholders juicing every drop out of them. Consider this as launching an altogether new card but with an existing name. So, almost everything has changed, barring a few. This is what Axis changes to their HNI Credit Cards.

Axis Magnus New Fees and Welcome Benefits

The Fees for Axis Magnus have been increased from INR 10K to INR 12.5K for cardholders onboarded from 1st September 2023. These new cardholders have the option to choose any of the below welcome benefits worth INR 12.5K:

- Luxe Gift Card

- The Postcard Hotels gift voucher

- Yatra gift voucher

As of now terms & conditions of these gift cards haven’t been made public. However, Yatra seems a good option unless there are restrictions. The Postcard hotel gift voucher would not be sufficient for even one night, but I would still consider it a good option as their properties are top-notch.

Credit cards with an anniversary year after 1st September will not receive any renewal benefit, irrespective of the date of issuance. So, both old & new cardholders will not receive any renewal benefits. Earlier, you would receive a Tata Cliq voucher worth INR 10K each year.

Annual Fees Waiver

Annual Fees Waiver terms & conditions have been changed both for Axis Magnus & Axis Reserve Credit Card. And, the amount required for fee waiver seems mostly impossible.

Axis Magnus Fees waiver has been increased by 67% to INR 25 Lac from INR 15 Lac. For Axis Reserve Credit Card, this has been increased by 40% to INR 35 Lac from INR 25 Lac.

However, cards with an anniversary year till 31st August 2024 can waive their fees with old waiver spending. You must spend INR 25 Lac on Magnus or INR 35 Lac on Reserve to get a fee waiver.

For Example, my Magnus card anniversary year falls in November. So, if I spend INR 15 Lac by November 2023, my fees will be waived. However, for November 2024 anniversary year, I will have to Spend INR 25 Lac to get a fee waiver of INR 10 Lac.

Base Points Earning

From 1st September 2023, No reward points will be given for spending on Utilities and Government Institutions. These will also be excluded from Annual Fees Waiver. This could impact several cardholders who were paying Maintenance, Electricity charges or Income Tax with their credit cards.

For Axis Magnus, you will continue to earn 12 reward points per INR 200 spent up to INR 1.5 Lac per month. After that, you will earn 35 reward points per INR 200 spent. These aren’t bonus points but rather base points. The terms & conditions of INR 1.5 Lac spending hasn’t been shared yet. But should exclude Wallet, Rent, utilities and government institutions transactions.

There is no charge for Axis Reserve on points earning except for Utilities & Government spending same as Axis Magnus.

Bonus Points Earning

This is where Axis has axed the benefit of Axis Magnus. Earlier, you used to get 25K Edge Points on a monthly spend of INR 1 Lac. Now this benefit has been removed.

Also, 60 Edge Points per INR 200 spent will be given on spent up to INR 2 Lac on travel edge. After INR 2 Lac is spent, you will earn 35 Edge Points per 200 spent.

Lounge Access

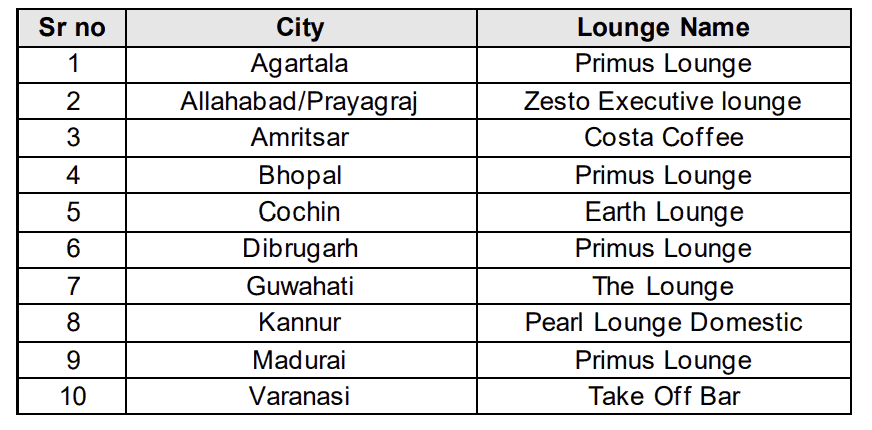

Now you can visit these new lounges in the domestic sector with your Priority Pass membership. Other domestic lounges can continue to be accessed with Magnus & Reserve Credit Card.

Points Conversion of Axis HNI Credit Cards

Earlier, the point conversion was 5:4 for both Axis Magnus & Reserve. This has now been done away with from 1st September 2023. From 1st September 2023, any points transfer will be done with 5:2 for Axis Magnus & Reserve.

However, for Burndany Private Cardholders, it will continue to be 5:4. Also, Axis is promoting Burgandy Account openings, as you can get a 5:4 conversion if you have both a Burgandy account & Axis Magnus. This does not apply to Axis Reserve as per the official communication. However, more clarity is required on this aspect from Axis.

What happens to your existing milestone points?

Axis has clarified that milestone points of May & June will be credited by 31st July 2023. The Milestone benefit of July will be credited by the 10th of August 2023. At the same time, the August milestone will be credited after 90 days and convertible with a 5:2 ratio.

Other bonus points earned on Travel Edge, Gift Edge and GyFTR will be credited per their usual timeline, as there is no official communication.

Here is the official communication:

Axis Changes HNI Credit Card Effect

Axis Magnus has been completely revamped, and few changes have been made to Axis Reserve. Existing cardholders who have used and reaped the benefits will probably close the card and move to a smaller, efficient Axis Atlas card.

It was unsustainable to give benefits anyway, so changes were necessary, but the exploitation by many has also taken benefits from genuine cardholders.

How bad is the change?

Let’s say there are two Magnus Cardholders, one was spending INR 1 Lac named “A1”, and the other was spending INR 2 Lac named “A2”.

Assuming all spending was eligible for the usual 12 points per INR 200 spent. So, A1 received 6K usual points and A2 12K usual points. On top of that, both were eligible for 25K Bonus points.

So, A1 had 31K points for a month, and A2 had 37 points for a month. These points were convertible for 5:4 giving 25% return to A1 and 15% to A2.

With the changes, A1 will get a 2.4% reward rate and A2 3.55%.

So, spenders even spending INR 2 Lac, the changes are significant. Even if one opens a Burgandy account and gets a 5:4 ratio, the reward rate will only double.

Bottomline

Axis makes significant changes to HNI Credit Cards, namely Axis Magnus & Axis Reserve. These changes aren’t great and will probably major the number of cardholders. Axis wants to increase its profit with its credit card business asap.