HDFC has been issuing different variants of Regalia Credit Cards for many years. Last year, they introduced HDFC Regalia Gold to fill the void between Infinia and Regalia. To some extent, it has been able to fill that void. In this review, let’s learn more about the HDFC Regalia Gold Credit Card.

Overview: HDFC Regalia Gold

Here is an overview of the HDFC Regalia Gold Credit Card:

| Type | Rewards |

| Joining Fees/Annual Fees | INR 2500 Plus Taxes |

| Welcome Benefits | Gift Voucher worth INR 2.5K Club Vistara Silver Tier, MMT Black Elite |

| Renewal Fees | INR 2500 Plus Taxes |

| Reversal of Annual Fees | INR 4 Lacs Spending |

| Forex Markup Charges | 2% Plus Taxes |

| Lounge Access | Domestic-12/Year INTL-6/Year |

| Default Reward Rate | 1.33% |

| Maximize Reward Earn By | SmartBuy 5x at Select Brands |

| Redemption Maximization | Gold Catalogue Points Transfer |

| Stand Out Feature | Complimentary Airport Drop Voucher |

HDFC Regalia Gold Eligibility

To be eligible for HDFC Reglia Gold:

- You should be a Minimum of 21 Years old,

- Earning Net Monthly Income of INR 1 Lac or 12 Lac Per Annum

Annual Fees

HDFC Regalia Gold Credit Card has annual fees of INR 2.5K plus taxes. However, getting this card for the first year free is possible.

Welcome Benefits

As a welcome benefit, you get three benefits:

- INR 2.5K worth of Gift Voucher

- Club Vistara Silver Membership

- MMT Black Elite Membership

Fee wavier on Regalia Gold

If you spend INR 4 Lacs in your card anniversary year, your annual fees of INR 2.5K will be waived.

HDFC Regalia Gold Reward Earning

You will earn 4 HDFC points for every INR 150 spent. However, there are many ifs and buts on eligible transactions.

5x Earnings at Select Brands

HDFC Regalia Gold has a unique feature. You will earn 20 [5x] reward points on every INR 150 spent at Marks & Spencer, Myntra, Reliance Digital, and Nykaa. All these brands cater to different needs. Myntra and Nykaa are the most common, whereas Reliance Digital is good for electronics.

You can earn a maximum of 5K monthly reward points across these brands with eligible e-com and POS transactions.

Accelerated Earnings via HDFC SmartBuy

As a Regalia Gold Cardholder, you can earn accelerated reward points using HDFC SmartBuy. Only premium credit cards from HDFC earn reward points on smartbuy, whereas other credit cards get cashback.

| HDFC SmartBuy Category | Accelerated |

| IGP.com | 10x |

| Flights | 5x |

| Hotels | 10x |

| IRCTC | 3x |

| RedBus | 5x |

| Instant Voucher | 5x |

| Apple Imagine Tresor | 5x |

| Zoom Car | 5x |

| Nykaa | 5x |

| Jockey | 10x |

| MMT Holiday Packages | 5x |

Even though this card is eligible for accelerated earnings, there is a cap of 2K Bonus Points per day and 4K per month on points earned via HDFC SmartBuy.

Complete Exclusions

You will not earn any reward points on the following:

- Fuel Transactions

- Rental Transactions [1% Fees from 2nd Transaction]

- Maintenance Transactions

- E-Wallet

- Smart/EasyEMI

- Packers & Movers Transactions, and

- Government Transactions

Caping on Reward Points Earnings

HDFC has put a few limits on reward points that you can earn on the Regalia Gold Credit Card. These limits are:

| Transactions | Points Limit |

| All Spending | 50K/Month |

| 5x Brands | 5K/Month |

| Grocery | 2K/Month |

| Insurance | 2K/Per Day |

| HDFC SmartBuy | 2K/Per Day |

| HDFC SmartBuy | 4K/Per Month |

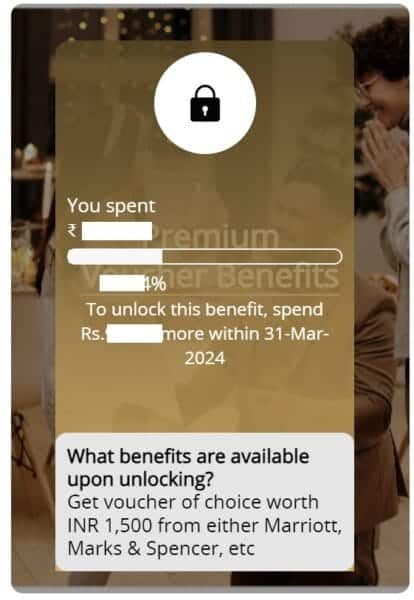

Milestone Benefits of Regalia Gold

There are Quarterly & Yearly Milestone benefits on the Regalia Gold Credit Card.

| Timeline | Spending | Benefit | Brands |

| Quarterly | INR 1.5 Lacs | 1.5K Voucher | Marriott, Myntra Marks & Spencer Reliance Digital |

| Card Anniversary Year | INR 5 Lacs | 5K Flight Voucher | SmartBuy |

| Card Anniversary Year | INR 7.5 Lacs | 5K Flight Voucher | SmartBuy |

If you are unsure of your milestone, log in at HDFC SmartBuy and check the amount yet to be spent. This feature is available for both Quarterly and Annual Milestones.

How much benefit can you get from Regalia Gold?

For the fee of just INR 2.5K, Regalia Gold packs a punch. Even if I don’t consider any accelerated points earnings, you could still get a 2.67% benefit on INR 7.5 Lacs spent, including the two flight vouchers. If you reach INR 1.5 Lacs during any quarter, this reward rate will increase to 2.87%.

So, with the 5x brands and HDFC smartbuy accelerator, it is easy to reach a reward rate of 4% on the HDFC Regalia Gold Credit Card.

Redemption of Rewards Points

HDFC used to be stringent about earning reward points; now, it also caps the number of points that can be redeemed in a month. This is even applicable to Regalia Gold.

You can redeem HDFC Regalia Gold Reward Points for:

- Gold Catalogue [1RP=INR 0.65]

- Flights & Hotel Booking at SmartBuy [1RP=INR 0.5]

- Transfer to HDFC Transfer Partners [1RP=0.5 Miles/Points]

- Vouchers [1RP=INR 0.35]

- Statement Credit [1RP=INR 0.2]

For use at SmartBuy, 50K points can be redeemed monthly with a maximum of 70% use against the total bill. For statement credit, a maximum of 50K points can be redeemed.

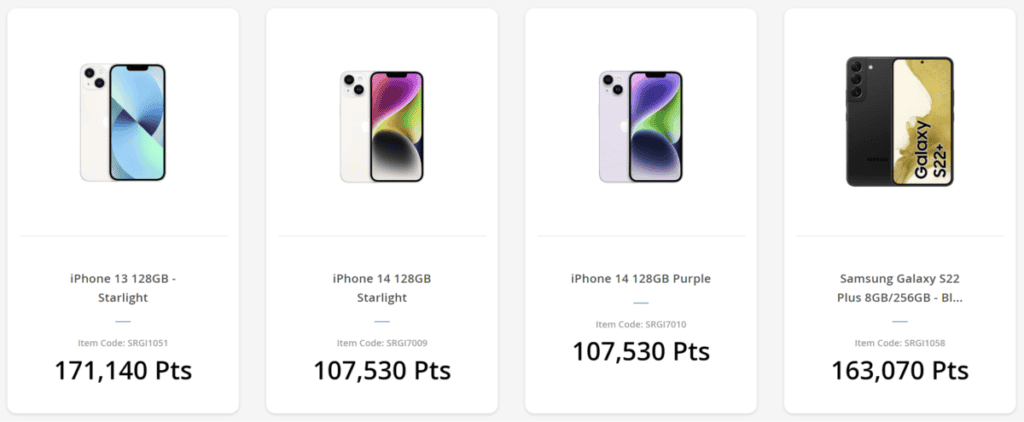

Regalia Gold Catalogue

The Regalia Gold Catalogue feature is based on Infinia, and the products are identical. However, the only difference is that one reward point value is INR 0.65, whereas for Infinia, it is INR 1. However, items in this catalogue are at MRP, and you lose out on discounts or offers. You should not redeem points for the Gold Catalogue unless you have a lot of them.

Transfer to HDFC Transfer Partners

Regalia Gold points can be transferred to the same airline and hotel partners to which Infinia and Diners Black cardholders have access.

In the case of airline partners, the transfer ratio is 2:1 for most partners, and for a few partners, the ratio is 3:1. I would still say 2:1 is decent as you can get more value out of points.

| Airlines | Frequent Flyer Program | Airline Alliance | Conversion Ratio |

| Air Canada | Aeroplan | Star Alliance | 100:33 |

| Air Asia | AirAsia rewards | None | 100:50 |

| Avianca | Lifemiles | Star Alliance | 100:50 |

| British Airways | Executive Club | OneWorld | 100:33 |

| Etihad Airways | Etihad Guest | None | 100:33 |

| Finnair | Finnair Plus | OneWorld | 100:50 |

| AirFrance/KLM | Flying Blue | SkyTeam | 100:50 |

| Hainan Airlines | Fortune Wings Club | None | 100:50 |

| SpiceJet | SpiceClub | None | 100:50 |

| Vietnam Airlines | LotusSmiles | SkyTeam | 100:50 |

| Turkish Airlines | Miles & Smiles | Star Alliance | 100:50 |

| United Airlines | United Mileage Plus | Star Alliance | 100:33 |

| Singapore Airlines | KrisFlyer | Star Alliance | 100:50 |

| Vistara Airlines | Club Vistara | None | 100:50 |

All hotel partners have the same transfer ratio of 2:1. With Accor, you can get a value of INR 0.9 per point, increasing the reward rate.

| Hotels | Conversion Ratio [For Regalia Gold] |

| ALL-Accor Live Limitless | 100:50 |

| Club ITC | 100:50 |

| IHG One Rewards | 100:50 |

| Wyndham Rewards | 100:50 |

At the beginning of the year, HDFC devalued the Infinia transfer ratio for Avianca, Turkish Airlines, and Accor and made it equal to Regalia Gold. Thus, there is less differentiation between these two cards based on transfer partners.

Lounge Access Benefit

With an HDFC Regalia Gold Credit Card, you can access domestic and international lounges. Currently, there is no spending requirement to be eligible for lounge access with this card.

| Lounges | Limit |

| Domestic | 12/YR |

| International | 6/YR |

Add-on card members are also eligible for lounge visits. However, the limit is capped at 12 domestic and six annual visits to the international lounge for all cards. If you exhaust your six quota of international lounge visits, you will be charged $27+ taxes for additional visits.

I think Lounge Access on this credit card is good for the fees.

Complimentary Airport Drop Voucher

If you have booked your flight tickets using HDFC Regalia Gold on HDFC Smartbuy, you get one complimentary Airport Drop Voucher. You can only get two complimentary Airport Drop Vouchers in a quarter.

This voucher applies to the Uber app and is worth INR 300. However, the voucher amount is not mentioned anywhere on the website. But still, this is a good initiative from HDFC Bank; you get this voucher and 5x points on your booking.

Other Benefits

You also enjoy these benefits on your HDFC Regalia Gold Credit Card:

- Forex Markup of 2% plus taxes [use HDFC Global Value Program for cashback]

- Zero Lost card liability if you lose your credit card [Make sure to call the 24-Hour Call Centre & report it]

- Discount on payment via Swiggy Dineout at Restaurants

- Accidental air death cover INR 1 Cr [Link]

- Emergency overseas hospitalization up to INR 15 Lacs

- Credit Liability covers up to INR 9 Lacs.

To use Regalia Gold Conerige, call 18604251188 or use the email id regaliagold.support@smartbuyoffers.co.

Bottomline

HDFC Regalia Gold is a good card from HDFC Bank. It has been designed to offer certain benefits offered by top-notch cards, and it hits the right spots most of the time. If you are eligible for this card and want to be part of the HDFC ecosystem, it is a good card.