CashBack Credit Cards are the favourites of many. It takes away lots of calculations usually required for airmiles. You simply use it at eligible partners and earn cashback in your credit card statement. Over the past few years, many cards have emerged to claim the throne of being the best cashback credit cards. At the same time, some cards have lost shine. But which cashback credit cards are out there? Here is what the market offers.

Which Cards are not covered here?

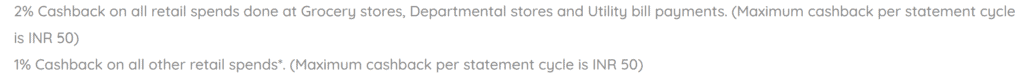

Some credit cards offer petty cashback, such as INR 50,100 or 500 per month, like the one below. Here, we cover only cards with a minimum monthly cashback of INR 1K.

Also, cards that require the credit cardholder to take action to earn cash back, such as converting points or requesting statement credit—for example, the HDFC Pixel Play Credit Card, HDFC Bank Millennia Credit Card or Standard Chartered Smart Credit Card—are not covered here.

How is cashback calculated?

Cashbacks are rounded down. That means if, mathematically, the cashback is INR 6.75 on a transaction, you would receive a cashback of INR 6.

Let’s say you have a card on which you earn 1% cashback and just spent INR 9999. After this transaction, you will receive a cashback of INR 99, not INR 99.99, since the cashback has been rounded down.

Why does CashBack Credit Card work?

Not everyone is interested in Airmiles or Points. Some want to keep things simple, and some want the best of both worlds. So, CashBack credit is for everyone who is looking for a good card.

One benefit of having a cashback credit card is its simplicity. You just swipe the card and the cashback is credited back to your statement.

Also, when this cashback hits your statement, you are free to use the cash in any way you want. So, there is no restriction, expiry, or devaluation.

List of CashBack Credit Cards in India

In India, almost every bank offers CashBack credit cards; however, select cards made to this list of cashback credit cards:

- Axis Ace Credit Card

- Airtel Axis Bank Credit Card

- Fibe Axis Bank Credit Card

- Flipkart Axis Bank Credit Card

- Swiggy HDFC Bank Credit Card

- Tata Neu Infinity HDFC Bank Credit Card

- Tata Neu Plus HDFC Bank Credit Card

- Amazon Pay ICICI Bank Credit Card

- Myntra Kotak Credit Card

- HSBC Live+ Credit Card

- SBI CashBack Credit Card

Axis Ace Credit Card

This card offers a sweet unlimited cashback @1.5% and also provides capped cashback via accelerated partners.

- Annual Fees: INR 499

- Fee Wavier: INR 2 Lakh Spend (Excluding Rent & Wallet Load)

- Forex Markup- 3.5%

- Regular Cashback: 1.5%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 4% & 5%

- 4% Cashback Partners: Swiggy, Zomato and Ola

- 5% Cashback Partners: Google Pay [bill payments of electricity, water, gas, LPG and broadband), DTH and mobile recharges

- Accelerated Cashback Limit: Total INR 500 Per Month (Inclusive for 4% & 5% Partners)

- Ineligible Categories:

- Utilities (Other than Google Pay)

- Fuel

- Clock, Jewelry, Watch & Silverware Stores

- Insurance

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services

- Government Services

- Lounge Access (Domestic): 4 Per Year (If spend is INR 50K in Previous 3 months)

- Cashback is credited in the next billing cycle within 3 days.

Axis Ace Credit Card is a decent entry-level card.

Airtel Axis Bank Credit Card

This Credit Card offers unlimited cashback @1% and also provides capped cashback via accelerated partners.

- Annual Fees: INR 500

- Welcome Benefit: INR 500 Amazon Voucher on 1st transaction within 30 days.

- Fee Wavier: INR 2 Lakh Spend (Excluding Rent & Wallet Load)

- Forex Markup: 3.5%

- Regular Cashback: 1%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 25% & 10%

- 10% Cashback: Swiggy, Zomato, & BigBasket

- 10% Cashback (Via Airtel Thanks App): Utility bill payments such as gas, electricity, etc.

- 25% Cashback (Via Airtel Thanks App): Airtel Mobile, Broadband, WiFi and DTH bill payments

- Accelerated Cashback Limit:

- 10% Cashback (For Swiggy, Zomato, & BigBasket): INR 500 Per Month

- 10% Cashback: INR 250 Per Month

- 25% Cashback: INR 250 Per Month

- Ineligible Categories:

- Utilities (Other than Airtel Thanks App)

- Fuel

- Clock, Jewelry, Watch & Silverware Stores

- Insurance

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services

- Government Services

- Lounge Access (Domestic): 4 Per Year (If spend is INR 50K in Previous 3 months)

- Cashback is credited in the next billing cycle within 3 days.

Airtel Axis Credit Card is better than the Axis Ace Credit Card if you spend primarily on Airtel. Also, 10% cashback on Zomato, Swiggy & BigBasket is good, too, with the generous capping of INR 500.

Fibe Axis Bank Credit Card

Fibe is a lending platform that has partnered with Axis to offer Fibe Axis Bank Credit Card. This card can be applied from the Fibe App.

- Annual Fees: INR Nil

- Fee Wavier: Not Needed

- Forex Markup: 3.5%

- Regular Cashback: 1%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 3%

- 3% Cashback: Online Food Delivery, Online Entertainment, Online Local Commute

- Accelerated Cashback Limit: INR 1500 Per Month

- Ineligible Categories:

- Utilities

- Fuel

- Clock, Jewelry, Watch & Silverware Stores

- Insurance

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services

- Government Services

- Lounge Access (Domestic): 1 Per Quarter (If spend is INR 50K in Previous 3 months)

- Cashback is credited in the next billing cycle within 3 days.

Flipkart Axis Bank Credit Card

Flipkart Axis Bank Credit Card is excellent if you spend on Flipkart & Cleartrip.

- Annual Fees: INR 500

- Fee Wavier: INR 3.5 Lakh Spend (Excluding Rent & Wallet Load)

- Forex Markup: 3.5%

- Regular Cashback: 1%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 4% & 5%

- 4% Cashback: CultFit, PVR, Swiggy & Uber

- 5% Cashback: Flipkart (Excluding Flipkart Health, Flipkart Travel & Flipkart Smartstore) & Cleartrip

- Accelerated Cashback Limit: Unlimited

- Ineligible Categories:

- Purchase of gift cards on Flipkart & Myntra platforms

- Utilities

- Fuel

- Clock, Jewelry, Watch & Silverware Stores

- Insurance

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services

- Government Services

- Lounge Access (Domestic): 4 Per Year (If spend is INR 50K in Previous 3 months)

- Cashback is credited three days before the statement generation date.

In a world with a limit on cashback, Flipkart Axis Bank Credit Card offers unlimited cashback.

Swiggy HDFC Bank Credit Card

The Swiggy HDFC Bank Credit Card has been making lots of noise recently. It is a decent card and deserves space in your wallet.

- Annual Fees: INR Nil (Limited Period Offer), else INR 500

- Welcome Offer: 3 Months Swiggy One Membership

- Fee Wavier: INR 2 Lakh Spend

- Forex Markup: 3.5% (Get 1% Cashback via Global Value Program)

- Regular Cashback: 1%

- Regular Cashback Limit: INR 500

- Accelerated Cashback: 5% & 10%

- 5% Cashback Online Partners:

- Apparels

- Department Store

- Electronics

- Entertainment

- Home Decor

- Pharmacies

- Local Cabs (Like Uber, Ola)

- Online Pet Stores

- Discount Stores (Like Amazon, Flipkart)

- 10% Cashback on Swiggy Including Dineout, Instamart excluding Swiggy Money Wallet, Swiggy Liquor, Swiggy Minis

- Accelerated Cashback Limit:

- 5% Cashback Partners: INR 1500 Per Month

- 5% Cashback on Swiggy: INR 1500 Per Month

- Total Cashback Limit: INR 3500 Per Month

- Ineligible Categories:

- Fuel

- Jewellery

- EMI’s

- Rental payments

- Wallet Load Transactions

- Government Services

- Insurance

Swiggy HDFC Bank Credit Card is a great card for beginners, considering it offers 5% cashback on many online merchants, unlike other co-branded cards, which give accelerated cashback on very few merchants. Plus, it is lifetime free for a limited time. However, there is an overall capping of INR 3500 per month across all spending.

Tata Neu Infinity HDFC Bank Credit Card

Tata Neu Infinity HDFC Bank Credit Card is from TATA. Even though it is not a pure cashback credit card, the Neu Coins are worth INR 1 and can be used across multiple partners, so it was added to this list.

- Annual Fees: INR Nil (Limited Period Offer), else INR 1499

- Welcome Benefit: 1499 Neu Coins, if fees is paid.

- Fee Wavier: INR 3 Lakh Spend

- Forex Markup: 2% (Get 1% Cashback via Global Value Program)

- Regular Cashback (In the form of Neu Coins): 1.5%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 1.5% (EMI & UPI) & 5%

- EMI Transactions get 1.5% Cashback

- 1.5% CashBack on UPI Transactions with Tata Neu UPI ID; else 0.5%.

- 5% Cashback Partners:

- Tata 1MG

- BigBasket

- Croma

- Air India Express

- Tata Cliq

- IHCL (TAJ Group of Hotels)

- Westside

- Qmin

- Tata Play

- Cult

- Tata Pay

- Titan

- Tanishq

- Air India

- Cashback (Neu Coins Capping)

- Grocery: 2K Neu Coins Monthly

- Insurance 2K Neu Coins Daily

- Utility: 2K Per Month

- Telecom & Cable: 2K Per Month

- UPI: 500 Per Month

- Croma: 30K Per month & 90K Annually

- Tata Cliq & Westside: 15K Per month & 90K Annually

- IHCL, Air India Express & Air India: 40K Per Month & 150K Annually

- 1MG, Cult & Tata Play: 10K Per month & 75K Annually

- BigBasket: 5K Per month & 60K Annually

- Titan & Tanishq: 30K Per month & 90K Annually

- Qmin Food Delivery via Tata Neu: 2.5K Per month or 30K Annually

- Earn 5% additional cashback via the Tata Neu App.

- Ineligible Categories:

- Fuel

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services (Via third-party apps)

- Government Services

- Prepaid card/gift Card/Voucher Purchase

- Lounge Access (Domestic): 2 Per Quarter

- Lounge Access (Internation)1 Per Quarter.

- Neu Coins are credited within seven working days of the statement generation.

The Tata Neu Infinity HDFC Bank Credit Card is exceptional as you can earn unlimited 1.5% cashback, including on utilities. If you use this card on Tata Neu App, you earn a sweet 10% Neu Coins with a generous limit across partners.

Tata Neu Plus HDFC Bank Credit Card

Tata Neu Plus HDFC Bank Credit Card is a smaller version of Tata Neu Infinity.

- Annual Fees: INR Nil (Limited Period Offer), else INR 499

- Welcome Benefit: 499 Neu Coin, if fees is paid.

- Fee Wavier: INR 1 Lakh Spend

- Forex Markup: 3.5%

- Regular Cashback (In the form of Neu Coins): 1%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 1% (EMI & UPI) & 2%

- EMI Transactions get 1% Cashback

- 1% CashBack on UPI Transactions with Tata Neu UPI ID; else 0.25%.

- 2% Cashback Partners:

- Tata 1MG

- BigBasket

- Croma

- Air India Express

- Tata Cliq

- IHCL (TAJ Group of Hotels)

- Westside

- Qmin

- Tata Play

- Cult

- Tata Pay

- Titan

- Tanishq

- Air India

- Cashback (Neu Coins Capping)

- Grocery: 1K Neu Coins Monthly

- Insurance 2K Neu Coins Daily

- Utility: 2K Per Month

- Telecom & Cable: 2K Per Month

- UPI: 500 Per Month

- Croma: 6K Per month & 18K Annually

- Tata Cliq & Westside: 4K Per month & 24K Annually

- IHCL, Air India Express & Air India: 8K Per Month & 30K Annually

- 1MG, Cult & Tata Play: 2K Per month & 15K Annually

- BigBasket: 1K Per month & 12K Annually

- Titan & Tanishq: 6K Per month & 18K Annually

- Qmin Food Delivery via Tata Neu: 1K Per month or 12K Annually

- Earn 5% additional cashback via the Tata Neu App.

- Ineligible Categories:

- Fuel

- Financial Institutions / Cash Withdrawal

- Rental payments

- Wallet Load Transactions

- Educational Services (Via third-party apps)

- Government Services

- Prepaid card/gift Card/Voucher Purchase

- Lounge Access (Domestic): 1 Per Quarter

- Neu Coins are credited within seven working days of the statement generation.

- Earn a total of up to 7% Neu Coins, 2% via card & 5% on shopping on the app.

Amazon Pay ICICI Bank Credit Card

If you use Amazon day-in-day out, Amazon Pay ICICI Bank Credit Card is a must-have. It is a no-nonsense card ever.

- Annual Fees: INR Nil

- Welcome Benefit: 3-month Complimentary Amazon Prime membership+ 1 Month Eazy Diner Membership & other promotions.

- Forex Markup: 3.5%

- Regular Cashback: 1% Including on International Spends

- Regular Cashback Limit: Unlimited (In the form of Amazon Pay)

- Accelerated Cashback: 2%, 3% & 5%

- 2% Cashback Partners: E-books on Amazon, Amazon Pay Gift Cards, Amazon Pay Partners like Uber, etc using Amazon Pay wallet

- 3% Cashback Partners: Amazon (Non-Prime Member)

- 5% Cashback Partners: Amazon (Prime Member)

- Accelerated Cashback Limit: Unlimited

- Ineligible Categories:

- Amazon Business transactions

- Purchase of physical and digital gold on Amazon.in

- Fuel

- EMI’s

- Rental payments

- Cashback is credited within 2 days from the statement generation date.

Myntra Kotak Credit Card

You could have gotten 5% cashback earlier via a Flipkart Axis Bank credit card on Myntra. Now, Myntra has partnered with Kotak to launch a co-branded card. This card offers a 7.5% discount on Myntra and cashback on other transactions.

- Annual Fees: INR 500

- Welcome Benefit: Myntra Insider Select Membership, INR 500 Myntra voucher after spending of INR 500 in 30 days.

- Fee Wavier: INR 2 Lakh

- Forex Markup: 3.5%

- Regular Cashback: 1.25% (Not on Myntra, as you get a 7.5% discount upfront up to INR 750 per transaction)

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 5%

- 5% Cashback Partners: Swiggy, Swiggy Instamart, PVR, Cleartrip & Urban Company

- Accelerated Cashback Limit: INR 1000

- Ineligible Categories:

- Rent

- Fuel

- Wallet

- Rental payments

- Education (If done through UPI)

- UPI transactions below or equal to INR 2000

- Lounge Access (Domestic): 1 Per Quarter

- Cashback is credited within 30 days from the transaction settlement.

HSBC Live+ Credit Card

There are only three HSBC credit cards in the market, each catering to different types of spenders. One of these three cards is a cashback card, the HSBC Live+ Credit Card.

- Annual Fees: INR 999

- Welcome Benefit: 1K after HSBC Mobile Banking login & Spend of INR 20K in 30 days

- Fee Wavier: INR 2 Lakh

- Forex Markup: 3.5%

- Regular Cashback: 1.5%

- Regular Cashback Limit: Unlimited

- Accelerated Cashback: 10%

- 5% Cashback Partners: Dining, Food delivery and Grocery spends

- Accelerated Cashback Limit: INR 1000

- Ineligible Categories:

- Rent

- Fuel

- Wallet

- Rental payments

- Education

- Government

- Jewellery and antique items

- Gambling

- Tolls and bridge fees

- Security broker services

- Utilities

- Charity

- Wholesale clubs

- Lounge Access: 4 Domestic Lounge Per Year

- Cashback is credited within 45 days from the statement date.

SBI CashBack Credit Card

This card is the undisputed king as of now. The SBI CashBack Credit Card outshines almost every card on the list.

- Annual Fees: INR 999

- Welcome Benefit: NA

- Fee Wavier: INR 2 Lakh

- Forex Markup: 3.5%

- Regular Cashback: 1% (Offline) & 5% (Online)

- Regular Cashback Limit: INR 5K Per Month

- Ineligible Categories:

- Utility

- Insurance

- Fuel

- Rent

- Wallet

- School & Educational Services

- Jewellery

- Railways

- EMI

- Cashback is credited within two days from the statement date.

Summary

| Card | Regular CashBack | Accelerated CashBack | Regular CashBack Monthly Limit | Accelerated CashBack Monthly Limit | Apply |

| Axis Ace Credit Card | 1.5% | 4%/5% | Unlimited | INR 500 | Link |

| Airtel Axis Bank Credit Card | 1% | 10%/10%/25% | Unlimited | INR 500/ INR 250/ INR 250 | Link |

| Fibe Axis Bank Credit Card | 1% | 3% | Unlimited | INR 1500 | Link |

| Flipkart Axis Bank Credit Card | 1% | 4%/5% | Unlimited | Unlimited | Link |

| Swiggy HDFC Bank Credit Card | 1% | 5%/10% | INR 500 | INR 1500/ INR 1500 | Link |

| Tata Neu Infinity HDFC Bank Credit Card | 1.5% | 5% | Unlimited | Refer Each Partner | Link |

| Tata Neu Plus HDFC Bank Credit Card | 1% | 2% | Unlimited | Refer Each Partner | Link |

| Amazon Pay ICICI Bank Credit Card | 1% | 5% | Unlimited | Unlimited | Link |

| Myntra Kotak Credit Card | 1% | 5% | Unlimited | INR 1000 | Link |

| HSBC Live+ Credit Card | 1.5% | 10% | Unlimited | INR 1000 | Link |

| SBI CashBack Credit Card | 1%/5% | NA | INR 5000 | NA | Link |

Best CashBack Credit Card in India

Out of the 11 cards, six are one of the best cashback credits in India:

- Airtel Axis Bank Credit Card: Best Card if you have an Airtel number, broadband & DTH. (Apply)

- Flipkart Axis Bank Credit Card: Best Card if you spend significantly (like over INR 200K) on Flipkart for electronics and mobile phones. (Apply)

- Swiggy HDFC Bank Credit Card: If you can’t get an SBI CashBack Credit Card, this card is made up for it as accelerated categories include Apparel, Department Stores, Electronics, Entertainment, Home Decor, Pharmacies, Local Cabs (Like Uber, Ola), Online Pet Stores, Discount Stores (Like Amazon, Flipkart). However, it comes with a capping lower than the SBI CashBack Card. (Apply)

- Tata Neu Infinity HDFC Bank Credit Card: This is the best Card if you use Tata Brands. (Apply)

- Amazon Pay ICICI Bank Credit Card: No-nonsense card. Least exclusions. (Apply)

- SBI CashBack Credit Card: Best CashBack Card ever in India. (Apply)

Bottomline

Almost every bank in India offers a cashback credit card. However, you don’t need all of them. Having one or two is sufficient for the sweet tooth. I hold two cards from this list and am in the process of adding one or two more while closing one.